All Categories

Featured

In 2020, an estimated 13.6 million U.S. homes are certified financiers. These households control enormous wide range, approximated at over $73 trillion, which represents over 76% of all exclusive wealth in the U.S. These investors take part in investment possibilities generally inaccessible to non-accredited investors, such as investments secretive companies and offerings by particular hedge funds, exclusive equity funds, and equity capital funds, which enable them to grow their wealth.

Check out on for details concerning the newest recognized investor alterations. Banks normally money the bulk, however seldom all, of the funding required of any type of purchase.

There are largely 2 regulations that enable issuers of protections to use endless quantities of protections to investors. hedge funds accredited investors. Among them is Regulation 506(b) of Law D, which permits an issuer to sell protections to unrestricted recognized investors and up to 35 Innovative Financiers only if the offering is NOT made through general solicitation and general advertising

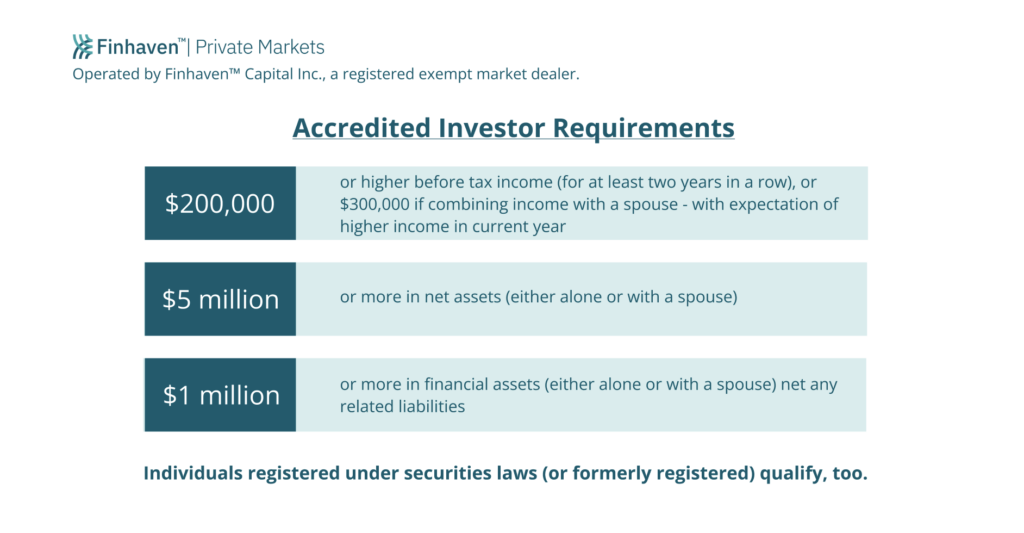

The freshly adopted amendments for the very first time accredit individual financiers based on economic elegance needs. Several other changes made to Policy 215 and Policy 114 A make clear and broaden the listing of entity types that can qualify as an accredited financier. Here are a couple of highlights. The amendments to the recognized financier definition in Policy 501(a): include as certified financiers any count on, with overall possessions greater than $5 million, not developed especially to buy the subject protections, whose acquisition is routed by an advanced person, or consist of as certified financiers any type of entity in which all the equity proprietors are accredited capitalists.

There are a number of registration exceptions that ultimately expand the world of prospective investors. Numerous exceptions require that the financial investment offering be made only to individuals that are certified investors (non accredited investor limits).

Furthermore, certified financiers commonly receive much more desirable terms and higher possible returns than what is readily available to the public. This is since private placements and hedge funds are not required to adhere to the very same regulative demands as public offerings, permitting for even more flexibility in regards to investment techniques and potential returns.

Rule 501 Of Regulation D Accredited Investor

One reason these safety offerings are restricted to accredited capitalists is to make certain that all getting involved capitalists are economically advanced and able to fend for themselves or maintain the risk of loss, hence rendering unnecessary the defenses that come from an authorized offering.

The internet worth test is reasonably straightforward. Either you have a million bucks, or you do not. On the income test, the individual has to please the thresholds for the three years constantly either alone or with a partner, and can not, for example, satisfy one year based on individual earnings and the next two years based on joint revenue with a partner.

Latest Posts

Mortgage Foreclosure Overages

Delinquent Property Tax Auction Near Me

Property Tax Foreclosures For Sale